Taxation Training Course in Delhi, Ghaziabad, Noida, "SLA Consultants" GST, ITR, SAP Certification, BAT Institute,

2 years ago Learning Delhi 274 views Reference: 51576Location: Delhi

Price: Contact us

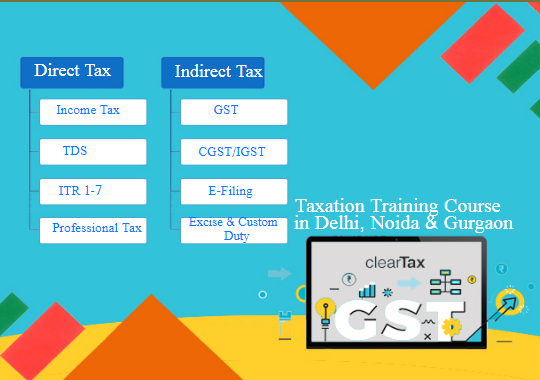

India's decision to use GST in the market will bring about a major change in the country's economy. This will simplify the process of delivering goods and services to the final consumer, significantly reducing the time and price of goods. However, one of the best ways the Indian economy can benefit from this move is by increasing opportunities for GST operators and tax advisors. Students who wish to pursue this career path can take advantage of this Taxation Training Course in Delhi to improve their chances.

High Employment Opportunities:

Accountants and bookkeepers need a lot after deciding to use GST.

The market is less competitive:

Fewer candidates want to become accountants, which increases your chances of finding the right job with less competition.

Different Roles:

Learning the GST will not only help students become tax accountants, but it will also open students up to many other jobs in accounting and finance. Aspiring tax professionals, tax attorneys, tax managers, finance department employees, and operations department employees can also take a goods and services tax course.

High pay scale:

One of the most motivating reasons to pursue a career in GST is the pay scale, which is unbelievable compared to other career profiles in this field.

Better Growth Opportunities:

As an accountant, students will gain a good overview of business processes, the importance of resources, and the identification of key issues that will soon increase growth opportunities in the finance industry.

Your own business:

If students don't want to work for other companies, students can set up their own consulting business and provide valuable advice to individuals and businesses on the details of GST.

Learning these benefits of the Accounting Training Certification in Delhi by SLA consultants will strengthen students' desire to become tax accountants. If students would like more information about GST and its long-term benefits, please visit SLA Consultants' offices in Delhi, Noida, or Gurgaon.

What will students learn at Taxation Training Institute in Delhi?

1. Learn more about the GST return file from GSTR1 to GSTR 11

2. Real-time implementation of complex GST services

3. GST registration

4. Upload the invoice to the GST portal

5. Using the RTGC wizard online and offline

6. You'll learn how to submit GST refunds for Composite Sellers, Regular Sellers, and more.

7. Payment of Taxes and Refunds

8. Gives confidence for the personal use of the GST portal.

And if in any case students haven't learned any aspects of the course and want to learn, students can always ask the Accounting Certification Classes in Delhi staff to get all their questions answered.

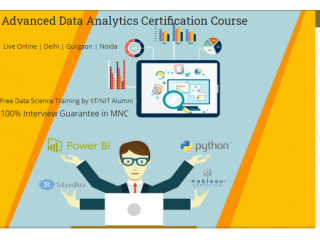

SLA Consultants India, Taxation Certification Institute in Delhi provides a 100% Interview Guarantee for all Graduate, PG, Fresher & work Experience learners. Institute is located in Laxmi Nagar, New Delhi; Noida & Online Accounting Certification Course in Delhi is available as well.

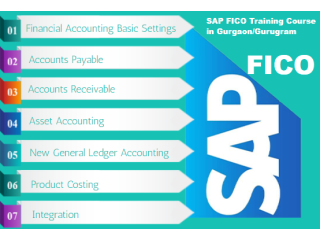

SLA Consultants, Taxation Training Course in Delhi, Ghaziabad, Noida, "SLA Consultants" GST, ITR, SAP Certification, BAT Institute,and Details is available at the link below:

https://www.slaconsultantsindia.com/advanced-direct-indirect-taxation-gst-training.aspx

https://slaconsultantsdelhi.in/training-institute-accounting-course/

GST Training, Income Tax, TDS Course ( Free Balance Sheet Finalization Training in Excel By CA)

Module 1 - GST- Goods and Services Tax - By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Visit Us at for Fee & New Year 2022 Offer by SLA Consultants

Contact Us:

SLA Consultants India

82-83, 3rd Floor,

Metro Pillar No 52

Vijay Block, Laxmi Nagar

New Delhi, 110092

Call: +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://slaconsultantsindia.com/